FAQs

What Is Banking Strategy Management Software?

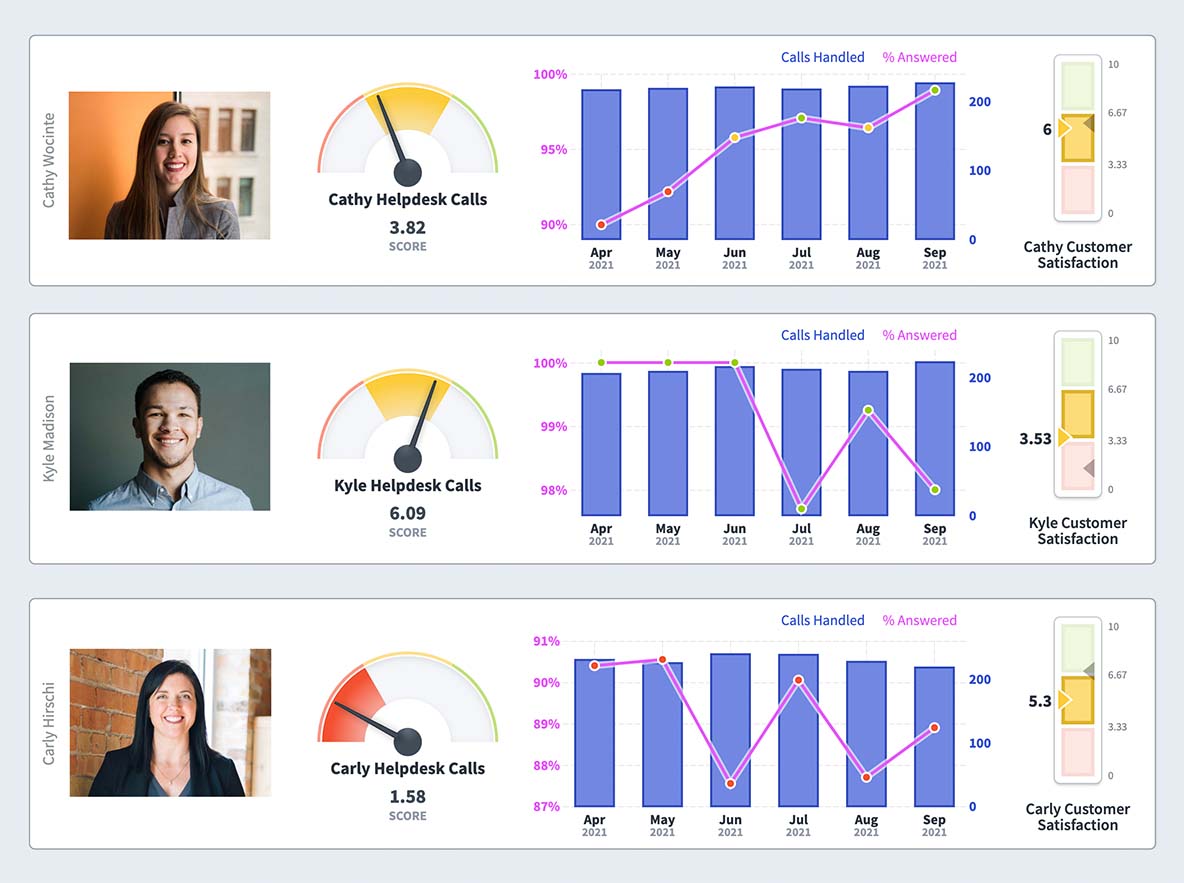

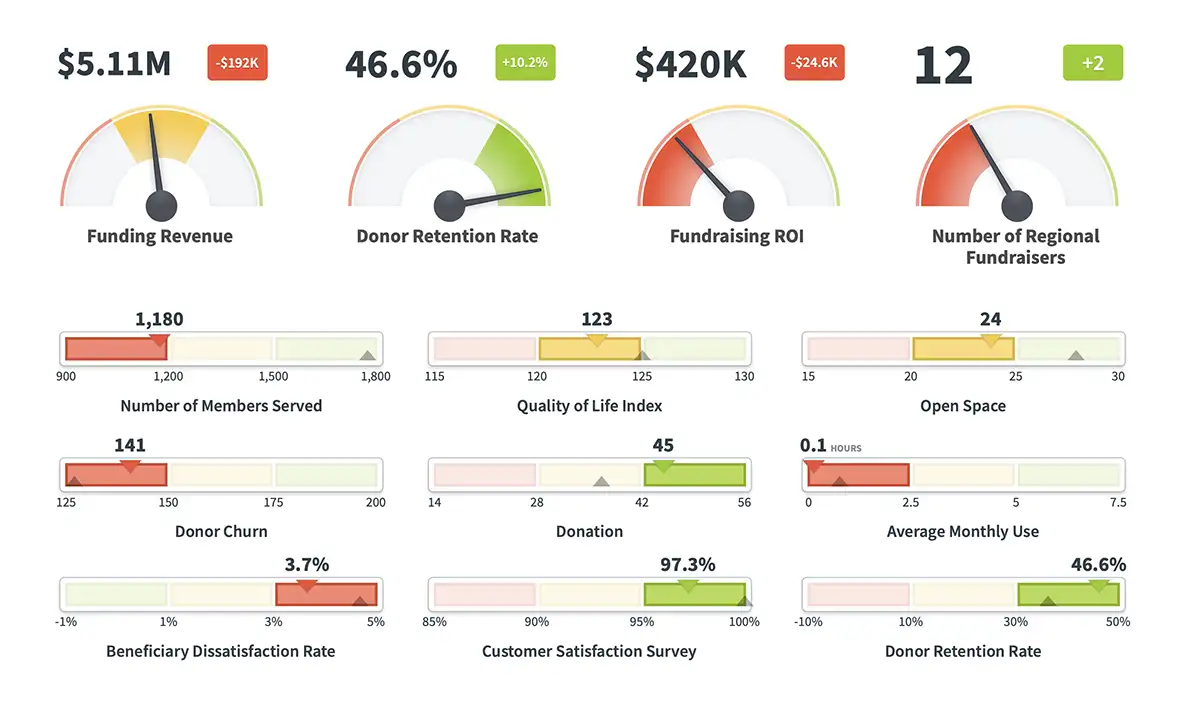

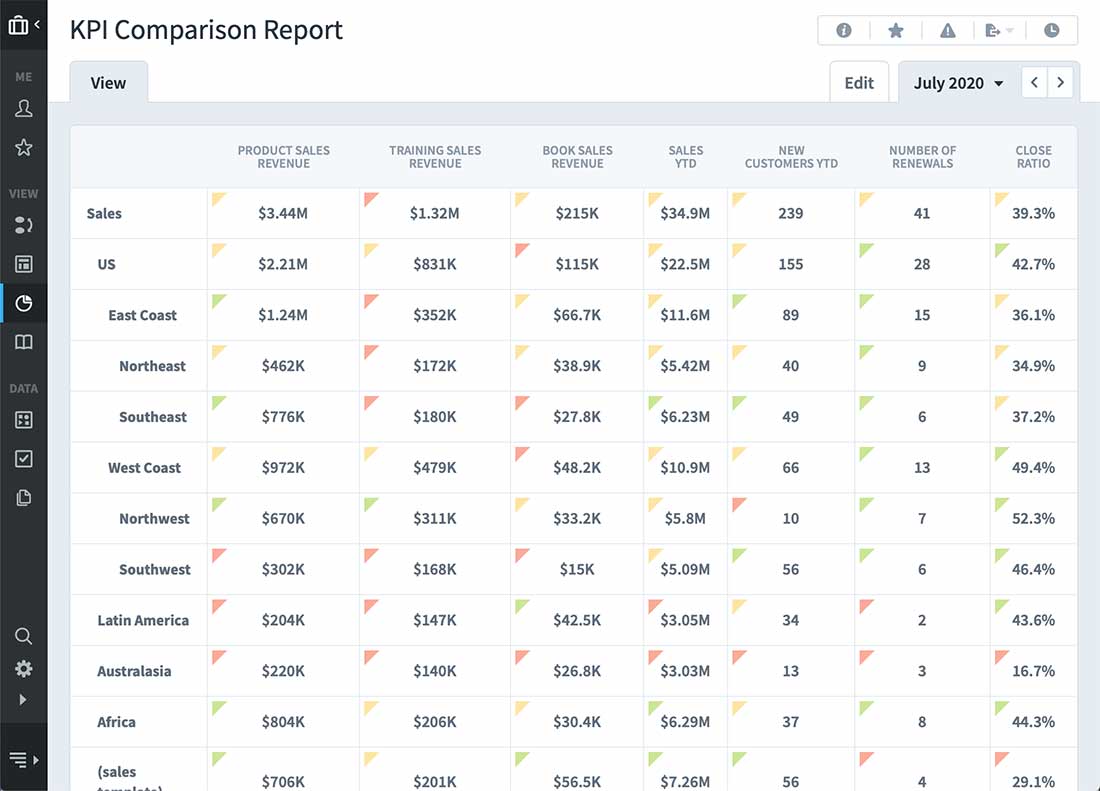

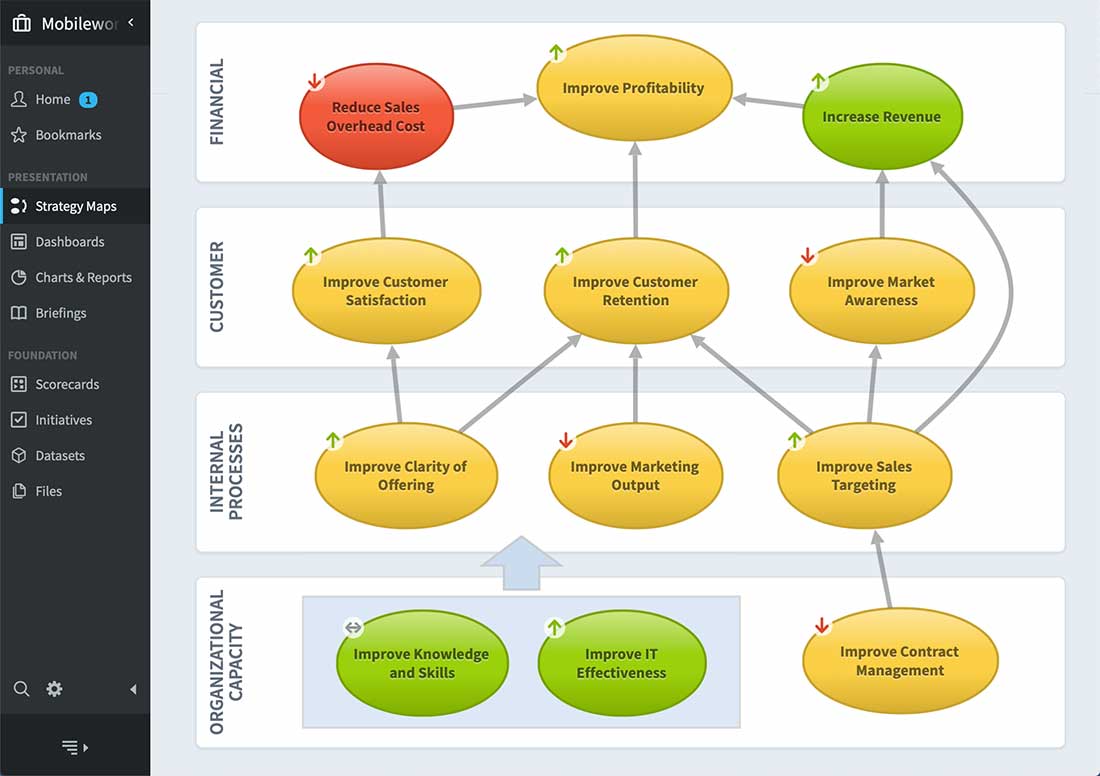

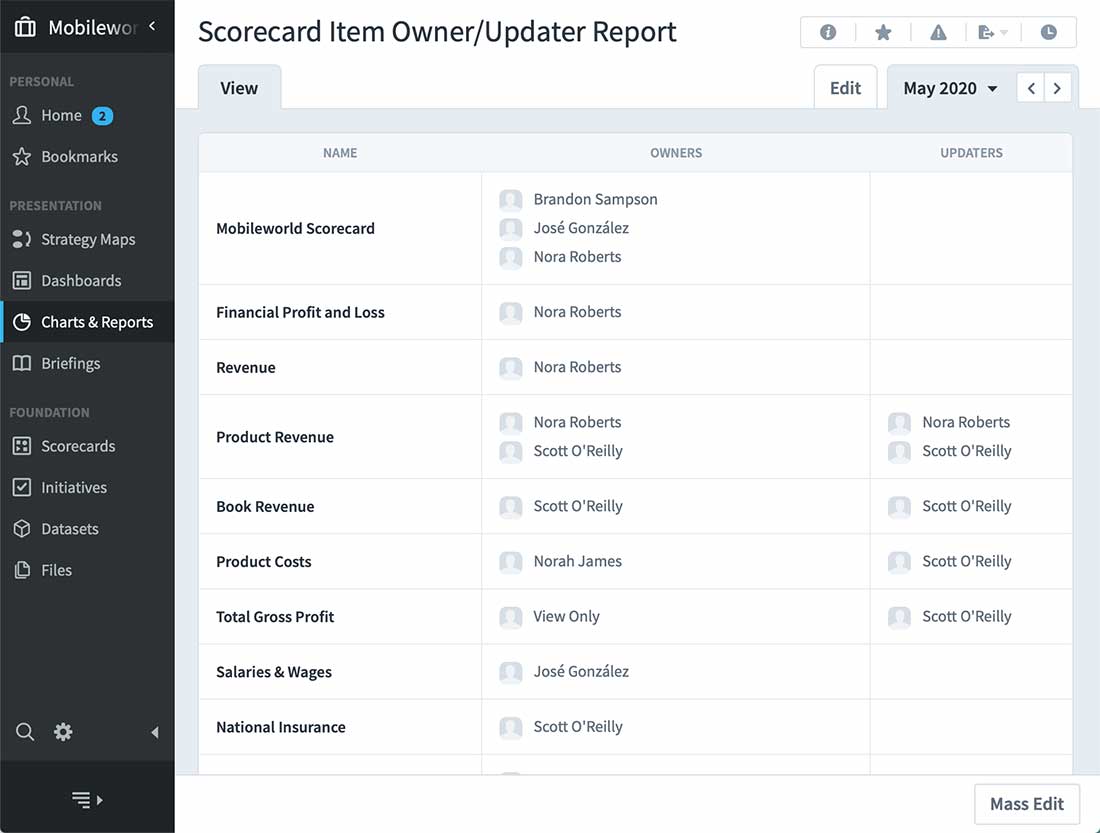

Banking strategy management software is a comprehensive tool designed to help financial institutions plan, execute, and monitor their strategic initiatives. It provides a centralized platform for tracking key performance indicators (KPIs), aligning departmental goals with overall strategy, and making data-driven decisions. This software typically includes features such as balanced scorecards, risk management tools, regulatory compliance tracking, and customizable dashboards tailored to the unique needs of the banking and finance sector.

How Does Finance Strategy Management Software Improve Performance?

Finance strategy management software improves performance by providing real-time visibility into an institution's key metrics and strategic initiatives. It helps align all levels of the organization with overarching goals, automates data collection and reporting processes, and offers predictive analytics for better decision-making. By centralizing data and providing powerful visualization tools, it enables financial institutions to identify trends, mitigate risks, and capitalize on opportunities more effectively. This leads to improved operational efficiency, better resource allocation, and ultimately, enhanced financial performance.

What are Some Example KPIs for Banking and Finance Strategy Management?

Our strategy software can track various banking and finance KPIs, including Asset turnover rate, Average sum deposited in new accounts, Cash conversion cycle (CCC), Cash flow return on investments (CFROI), and Cumulative annual growth rate (CAGR). These KPIs help financial institutions monitor performance effectively and make data-driven decisions.

How Does This Software Help with Regulatory Compliance?

Strategy management software helps with regulatory compliance by providing tools to track and report on compliance-related metrics automatically. It can set up alerts for potential compliance issues, generate required reports, and maintain audit trails. By centralizing compliance data and integrating it with overall strategy management, the software helps financial institutions stay proactive in their compliance efforts, reduce the risk of violations, and streamline the reporting process. This not only helps maintain regulatory adherence but also reduces the time and resources typically required for compliance management.

Can the Software Be Customized for Different Types of Financial Institutions?

Yes, quality strategy management software should be highly customizable to meet the specific needs of different types of financial institutions, whether they are retail banks, investment firms, credit unions, or other financial service providers. This customization can include tailoring KPIs, creating industry-specific dashboards, adjusting risk management parameters, and integrating with existing systems and data sources. The ability to customize ensures that the software can align with each institution's unique strategic objectives, operational processes, and regulatory requirements.